Technical Report, Scoping Study February 2025

In March 2025 Black Dragon Gold released details of an updated Scoping Study prepared by Bara Consulting (UK) Ltd. in relation to the Salave Gold Project in Asturias, northern Spain.

The Study demonstrates robust economics for an underground mining operation with a 14-year mine life plus two years of pre-production development and concurrent closure. This includes considerable improvements in nearly all financial and production metrics with minimal impact on Project development and sustaining costs.

The Scoping Study and associated Technical Report was conducted in accordance with the standards, recommendations and guidelines for public reporting as set out in the JORC Code (2012)

CAUTIONARY STATEMENT

- The Study is a preliminary technical and economic assessment of the potential viability of the Salave Gold Project. It is based on low level technical and economic assessments (+/-30% accuracy) insufficient to support estimation of Ore Reserves or an investment decision. Further evaluation work and studies are required before Black Dragon will be in a position to provide assurance of an economic development case at this stage, or to provide certainty that the conclusions of the Study will be realised.

- Mineral Resources considered in the Study include both Measured, Indicated and Inferred category resources as described under the JORC Code (2012 Edition). Investors are cautioned that there is a low level of geological confidence in Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources, or that the production targets themselves will be realised. Further exploration and evaluation work and appropriate studies are required before Black Dragon will be in a position to estimate any Ore Reserves or to provide any assurance of an economic development case.

- The production targets and resulting forecast project economics referred to in the Study are based on Mineral Resources comprising [9% Measured, 66% Indicated and 25% Inferred Mineral Resources, as converted by the use of the Modifying Factors as reported. The proportion of Inferred Mineral Resources considered here is not determinative of the project viability and does not feature as a significant proportion early in the mine plan.

- Metallurgical recoveries have been based on test work data considered sufficient for Scoping Study purposes, and costs have been estimated generally from budget quotations, factored estimates or cost data from previous similar operations/projects by Bara. Cost estimate accuracy for the Study is in the order of ±30%.

- The Scoping Study is based on the material assumptions outlined herein and in the attached Technical Summary. These include assumptions about the availability of funding. While BDG considers all of the material assumptions to be based on reasonable grounds, there is no certainty that they will prove to be correct or that the range of outcomes indicated by the study will be achieved. To achieve the range of outcomes indicated in the Scoping Study, among other things, funding of in the order of US$250 million will likely be required. Investors should note that there is no certainty that Black Dragon will be able to raise that amount of funding when needed.

- It is also likely that such funding may only be available on terms that may be dilutive to or otherwise affect the value of BDG’s existing shares. It is also possible that BDG could pursue other ‘value realisation’ strategies such as a sale, partial sale or joint venture of the project. If it does, this could materially reduce BDG’s proportionate ownership of the project.

- This announcement has been prepared in compliance with the JORC Code 2012 Edition (JORC 2012) and the ASX Listing Rules. All material assumptions on which the production targets and forecast financial information is based have been provided in this announcement (including the attached Technical Summary).

- Given the uncertainties involved, investors should not make any investment decisions based solely on the results of this Scoping Study.

KEY SCOPING STUDY OUTCOMES [1]

The key outcomes of the scoping study are the following estimates:

- Updated Mineral Resource Estimate per JORC (2012) comprising a total resource of 17.1Mt (M+I+I) at a grade of 2.85 g/t Au for a total of 1.56 Moz contained Au (as at 1 February, 2025)

- Planned expansion in ROM mining and processing to 1.2Mtpa

- Pre-Tax NPV5: US$ 631 million.

- After-Tax NPV: US$ 506 million

- Pre-Tax Internal Rate of Return (“IRR”): 34%

- After-Tax Payback: 3 years

- Pre-Production Capital Cost, including contingency: US$207 million

- Life of Mine (“LOM”) Sustaining Capital Cost: US$145 million

- Estimated Average LOM Total Cash Cost: $632/ounce (oz) Au

- Estimated Average LOM All-In Sustaining Cost (“AISC”): $790/oz Au

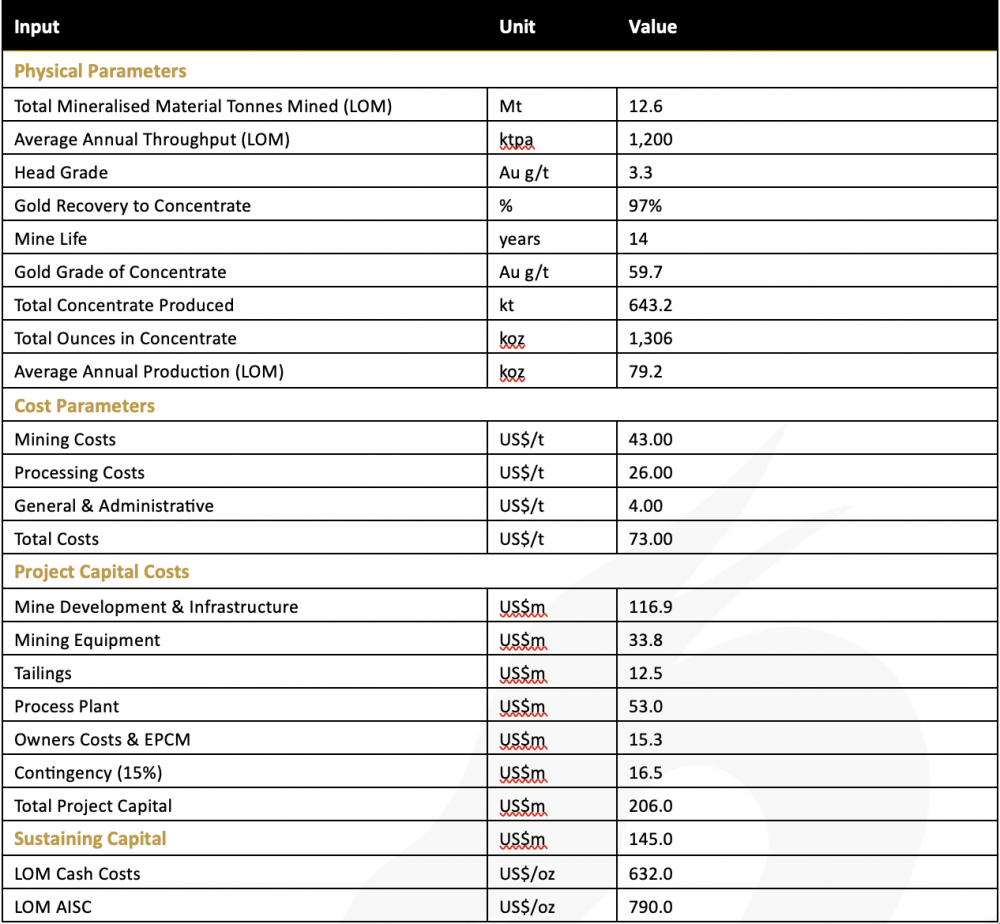

STUDY ASSUMPTIONS AND INPUTS

- Assumed gold price: US$2106/oz

- Exchange Rate of US$1.06/€1.00

- Life of Mine: 14-years

- Main Underground Mining Method: Sub-Level Open Stoping, with Cut & Fill

- Average Diluted Head Grade: 3.3 g/t Au

- Planned Dilution: 5%

- Planned Recovery: 85%

- Access Ramp Gradient of 15% at a 5.0m x 5.5m profile

- Mineralised Zone Development at a 4.0m x 4.5m profile

- LOM Plant Throughput 12.6 Mt

- Flotation Plant Recoveries: 97%

- Average Annual Production (LOM): 99,462 oz Au in concentrate at an average grade of 59.7 g/t Au

- LOM recovered gold in concentrate production: 1,293,420 oz;

- Au Payability 80% (incl. TC & RC)

[1] All figures are in United States Dollars unless otherwise stated.

Table 1 - Summary Study parameters

MINERAL RESOURCE ESTIMATE

Updated Mineral Resources have been reported from the 2018 block model following current consideration of Reasonable Prospects for Eventual Economic Extraction (RPEEE) via an updated assessment of mining methods, costs, commodity pricing and resulting cut-off grades which have informed the generation of conceptual designs used to constrain blocks in the model for reporting.

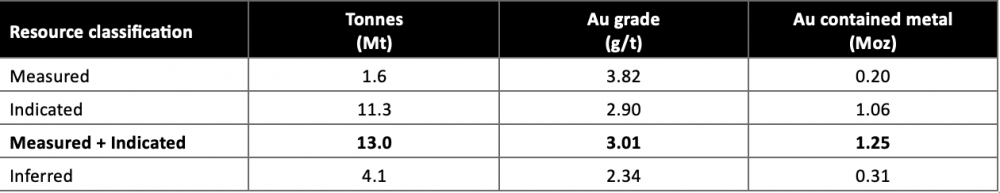

Table 2 - Salave MRE statement, JORC 2012 (as of 1 February 2025)

Notes:

- Classification of the MRE has been set out in accordance with the requirements set out in the JORC Code (2012 Edition); for more details refer to Appendix 2, Technical Summary.

- The MRE tonnes and grade stated is that material that is constrained by conceptual Mine Shape Optimiser (MSO) shapes produced by incorporation of the following parameters; gold price of US$2,405/oz, mining recovery of 100%, mining dilution of 0%, processing recovery of 97%, mining cost of US$55/t, processing cost of US$25/t, general and administration (G&A) costs of US$5/t, and a royalty of US$2.5/t, reflecting RPEEE, and a cut-off grade of 1.45 g/t Au (at 80% payability).

- All density values were interpolated into the block model from density sampling data using Inverse Distance Weighting (IDW), raised to the second power, except for the CHL and SER domains where a single density value of 2.67 t/m3 was used. The average interpolated density is 2.67 t/m3.

- Tonnes are quoted as rounded to the nearest 100,000 tonnes and contained metal to the nearest 10,000 ounces to reflect these as estimates.

- Rows and columns may not add up exactly due to rounding.

- Mineral Resources that are not Ore Reserves do not have proven economic viability.

- The quantity and grade of Inferred Resources are based on data that are insufficient to allow geological and grade continuity to be confidently interpreted such that they may be classified as Indicated or Measured Mineral Resources. Whilst it is the opinion of the Competent Person that it would be reasonable to expect that Inferred Mineral Resources might be upgraded to Indicated Mineral Resources following additional exploration, it should not be assumed that such upgrading would occur.

- The Competent Person responsible for the preparation of the MRE is Mr. Galen White, BSc. (Hons), FAusIMM, FGS.

2025 SALAVE MINE PLAN

The mine plan supported by the Study demonstrates that approximately 74% of the total 2025 updated Mineral Resource tonnage is amenable to extraction by underground methods.

For purposes of mine planning, the potentially extractable portion of the Mineral Resources are comprised of 12.6 million tonnes at a diluted grade of 3.3 g/t Au, containing just over 1.2 million ounces of gold.

The mine design was based on basic economic assumptions to create mineable stope outlines. A value of 1.75g/t was assumed as the mine cut-off grade. Mining dilution and mineralised material loss factors were also applied to each mining shape to reflect the selected mining method.

The mine plan targets nominal production of 1.20Mtpa RoM. A conceptual mine layout was designed including stopes and development as illustrated in Figure 9, with 60m levels and 3 x 20m sub-levels.

The total mineralised material from stopes and drives totals 12.6Mt at 3.3 g/t Au.

Figure 10 – Mining schedule

CAPITAL COSTS AND PROJECT ECONOMICS

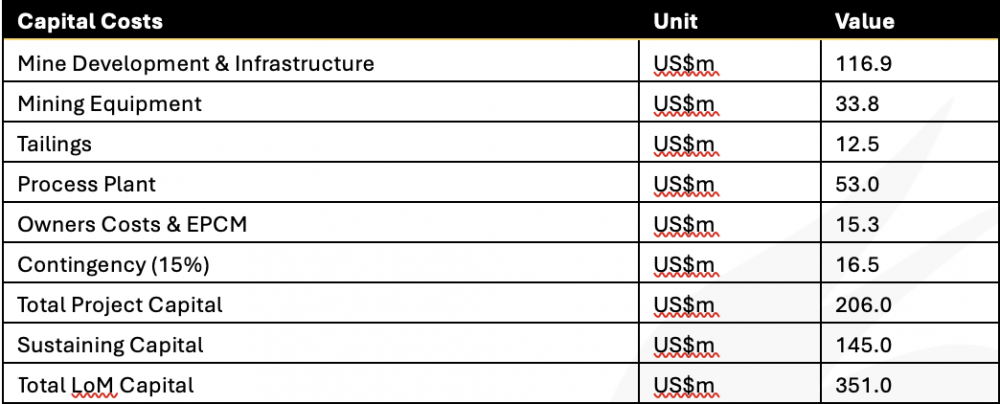

A summary of Project Capital costs as estimated in the 2025 Scoping study is presented in Table 5.

Table 5 - Capital costs

NPV and IRR of the project at a discount rate of 8%, based on gold prices as stated and the production schedule described, are robust. Project sensitivities to changes in costs and gold prices are shown in Figure 11. The project demonstrates robustness with respect to changes in capital and operating costs. The project is primarily sensitive to changes in gold price.

PROJECT FUNDING

The Board of BDG believes there is a reasonable basis to assume necessary funding for the Salave Gold Project will be obtained for the following reasons:

- The Company has been able to raise funding form a range of strategic and sophisticated investors over the past years in order to progress its project. BDG has raised over AUD$30 million via equity placements.

- These raises indicate a clear base of support from new and existing shareholders and third-party investors with a growing proportion of investment coming from Spain.

- The Company considers it will be able to raise funding for the next stage of the Project, which will advance the Project towards completion of a detailed Feasibility Study.

- Positive outcomes delivered by the Scoping Study give the BDG Board confidence in the ability of the Company to fund project development through conventional debt and equity financing. A mix of debt and equity is the most likely funding model so 100% of the capital expenditure will not need to be borrowed.

- The Board has a strong track record in financing project development and mining operations and, in its view, it is reasonably expected that should the project parameters indicated by this Study be met, funding will be able to be arranged.

- Notwithstanding this, the normal risks for the raising of capital will apply to the Company, such as the state of equity capital and debt markets, the results of the Feasibility Study in terms of capital required, NPV, IRR and payback, and the price of gold at the time.

The Company believes its funding opportunities will be improved at the completion of a Feasibility Study as a result of:

- Confidence in the possibility to increase the Mineral Resource Estimate that would serve to improve the mine life of the Project;

- Validation to PFS and ultimately FS levels of confidence of earlier metallurgical test work to support, optimise and potentially improve concentrate grades and support process plant design;

- Finalisation of further engineering studies to improve the accuracy of the assessed capital and operating costs; and

- Secure offtake contracts for concentrates to improve revenue and treatment charge assumptions.

KEY RECOMMENDATIONS

The Scoping Study and associated MRE were prepared by Bara Consulting (UK) Ltd, which has made the following recommendations for further stages of study on the project and potential optimisation of outcomes:

- Further refinement can be made to the Mineral Resource evaluation with the use of grade-constraining wireframes such that presently identified zones of internal waste can then be excluded. This would result in an improvement in the grade estimate by means of a reduction in the degree of grade ‘smoothing’ and associated uncertainty in the grade above cut-off, particularly in areas of Inferred Mineral Resources.

- Refinements should be made to 3D geological and alteration interpretations via enhanced sub-domaining of the alteration zones, thus producing a more robust block model. Vertical structures identified in drilling should now be reviewed to determine if they are potentially feeder zones which could then be modelled accordingly. Given most of the historical drilling is close to vertical, the potential for high-grade vertical structures needs to be explored in areas not adequately covered by angled drillholes.

- A limited programme of historic core re-sampling should be completed, focussed on the core of the deposit and this dataset compared to historical data to assess any bias and to test current assumptions as to the quality of historical data.

- Further physical property testwork and litho-geochemical analysis should be completed to fully understand the properties of the mineralisation. This would provide valuable insights into future geological, alteration and geometallurgical domaining of the deposit. Future geometallurgical modelling should include arsenic domaining.

- Geotechnical drilling and analyses including sampling, testwork and geotechnical modelling in the context of the proposed mine design should be completed to support geotechnical assessment and support requirements to PFS level.

- Geohydrological drilling and analyses, including ongoing level monitoring and lift tests to determine hydraulic conductivity at a range of depths selected in the context of the proposed mine design, will inform dewatering requirements, and support further appraisal of mining parameters and costs to PFS levels of accuracy.

- Sampling and metallurgical testing of composites from the Upper and Lower mineralised zones as well as testing of an overall LOM composite will be required. LOM variability testing may also be undertaken, although this is strictly speaking only required for feasibility levels of study.

- Development and implementation of targeted stakeholder engagement, as appropriate with identified stakeholders, is highly recommended ahead of further capital development on the project.

Based on implementation of the above, project progress through Pre-feasibility to Feasibility level study is recommended.